tax on unrealized gains uk

Instead we should calculate what the Corp tax liability would have been if they had been realised gains at the end of the company year and include this as deferred tax in the. See the Business Income Manual BIM39500 for the rules relating to unincorporated businesses.

Is Your Alpha Big Enough To Cover Its Taxes A 25 Year Retrospective Research Affiliates

I understand there has to be a fair value adjustment in the PL to refelct the increased value of the investment to.

. Bidens fiscal 2023 budget request released Monday would impose a 20 minimum tax on the unrealized capital gains for households worth at least 100 million. This creates an increased risk of unexpected taxable gains for companies. Although the aim of the FA 1993 legislation was to bring the taxation of exchange gains and.

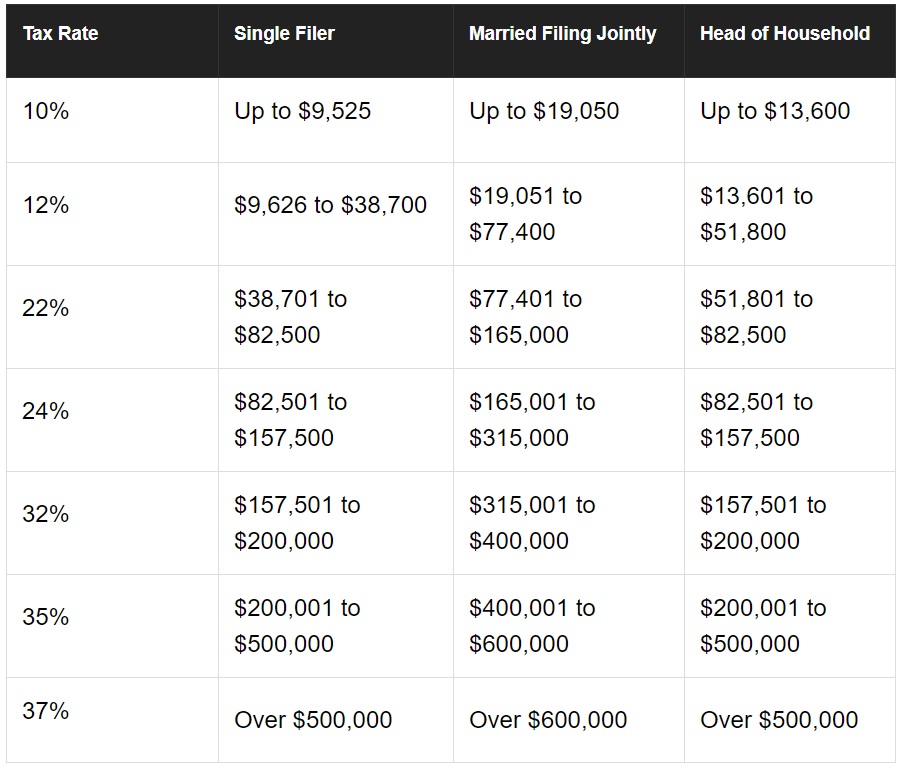

The bottom 50 meanwhile. Households worth more than 100. If youre a basic rate taxpayer you have t o pay 10 on your gains on normal assets but you have to pay 18 on the.

However on death a persons assets are valued and may be subject to. This tax called a billionaire minimum income tax would impose an annual 20 percent tax on. President Bidens Fiscal Year 2023 budget includes a new tax on unrealized gains.

Capital gains arise out of a disposal of the assetwhich can be by way of a sale or even a gift. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. Yahoo Finances Denitsa Teskova breaks down Democrats new proposal to tax the wealthiest Americans.

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. Under the proposed Billionaire. In 2018 the most recent year of tax data the top 1 of earners in the US.

If the proposal were. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Tax on unrealized gains uk Monday February 21 2022 Edit.

To increase their effective tax rate. The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that. In this article we go back to basics on the taxation of foreign exchange from a UK corporation tax perspective and also consider some of the options available to businesses to.

Households worth 100 million or more is drawing skepticism from tax experts. A tax on unrealized gains would harm the economy. Paid 040 of every 1 that the IRS collected in personal income taxes.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Its the gain you make thats taxed not the. This reflects the 10k investment and the 5k unrealised gain.

President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US. The basic tax rule in the UK is that foreign exchange movements on loans and derivatives are. Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to avoid the tax moving.

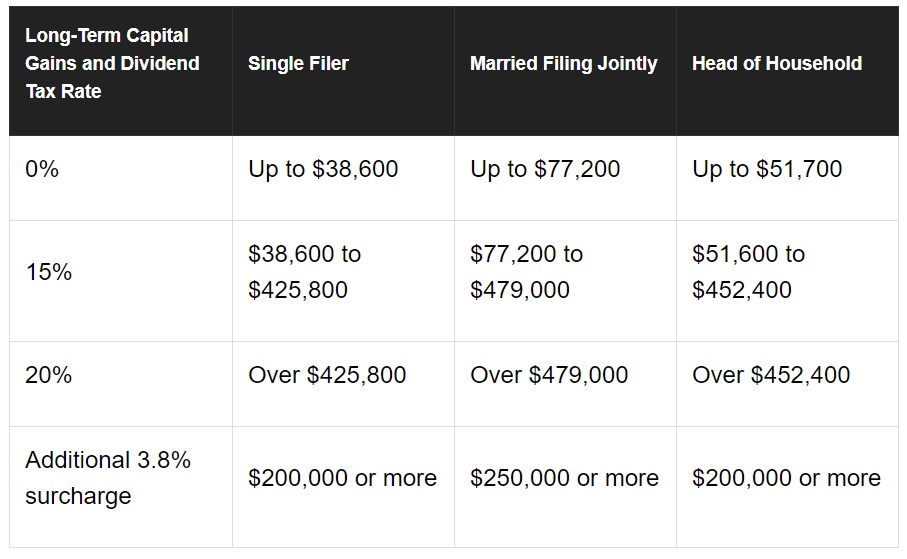

But one aspect of his proposal a minimum 20 tax on the unrealized gains of US. The Funds distributions are expected to be taxed as ordinary income andor capital gains unless you are exempt from taxation or investing through a taxadvantaged arrangement. Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million.

Intermediate Acct Cheat Sheet By Cmobe2 Download Free From Cheatography Cheatography Com Cheat Accounting Basics Financial Statement Analysis Cheat Sheets

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

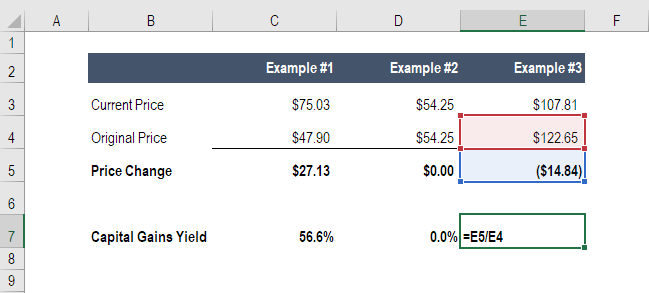

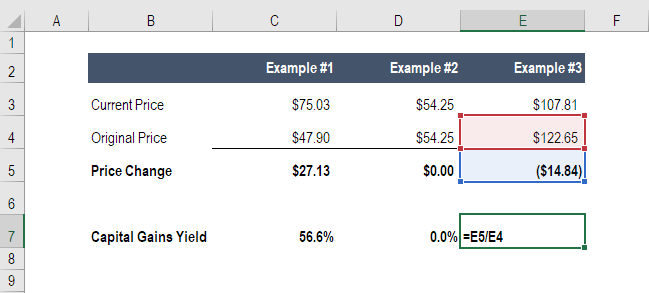

Capital Gain Formula And Taxes On Unrealized Realized Gains

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Yield Cgy Formula Calculation Example And Guide

Is Your Alpha Big Enough To Cover Its Taxes A 25 Year Retrospective Research Affiliates

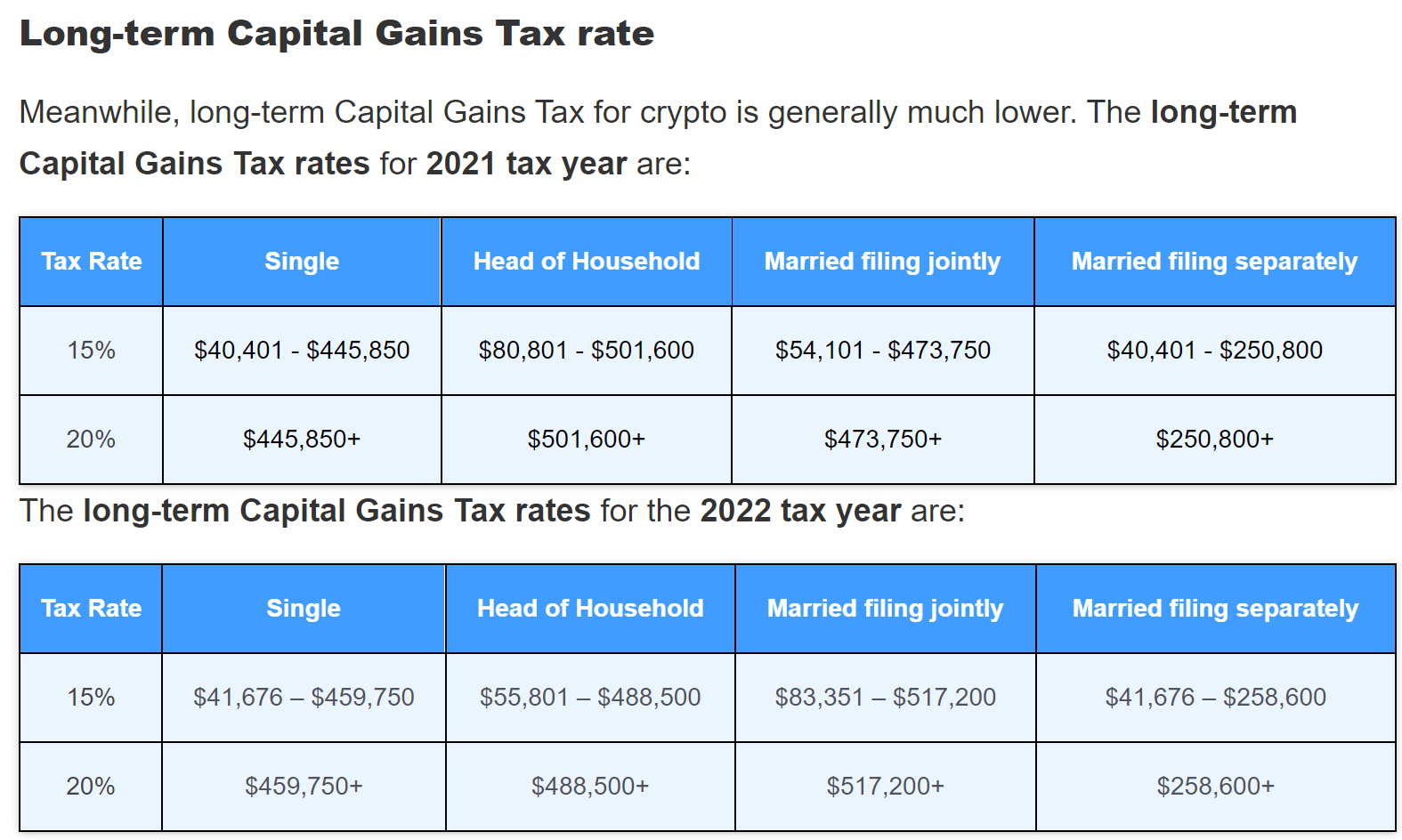

Thoughts On Virtual Crypto Currency Taxation In The Us Advanced American Tax

Treatment Of Foreign Currency Option Gains

How To Tax Capital Without Hurting Investment The Economist

Winter Is Coming Plan Ahead For Potential Tax Changes Context Ab

Forex Trading Academy Best Educational Provider Axiory Global

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

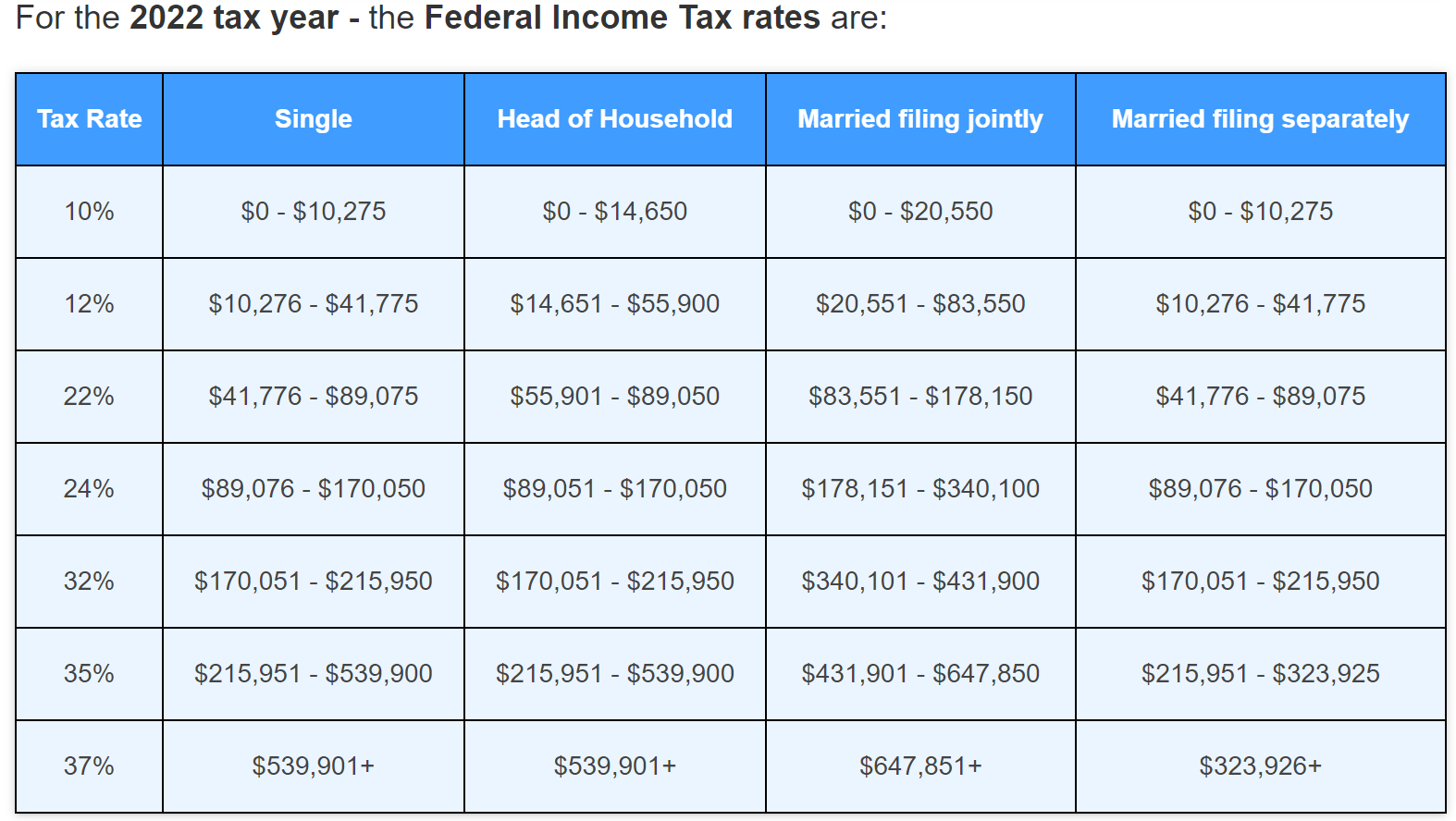

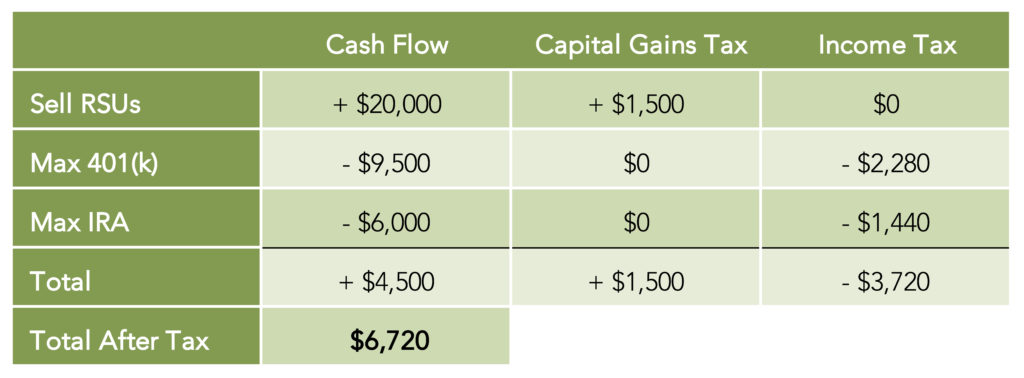

Rsu Taxes Explained 4 Tax Strategies For 2022

Thoughts On Virtual Crypto Currency Taxation In The Us Advanced American Tax

How Are Dividends Taxed Overview 2021 Tax Rates Examples

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong